pool ads

pool adsWhen the Price of (HTLFP) Talks, People Listen

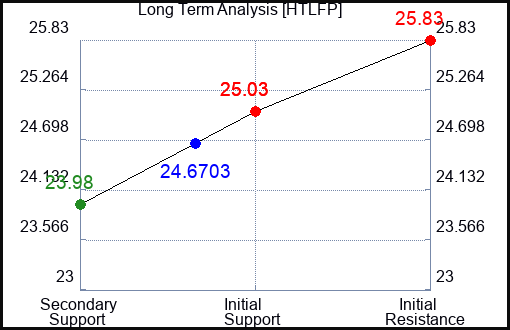

Longer Term Trading Plans for HTLFP

- Buy HTLFP slightly over 23.98 target 25.03 stop loss @ 23.91

- Short HTLFP slightly under 25.03, target 23.98, stop loss @ 25.1

Swing Trading Plans for HTLFP

- Buy HTLFP slightly over 25.03, target 25.83, Stop Loss @ 24.96

- Short HTLFP slightly near 25.03, target 24.65, Stop Loss @ 25.1.

Day Trading Plans for HTLFP

- Buy HTLFP slightly over 25.03, target 25.83, Stop Loss @ 24.97

- Short HTLFP slightly near 25.03, target 23.98, Stop Loss @ 25.09.

Check the time stamp on this data. Updated AI-Generated Signals for Heartland Financial Usa Inc. Depositary Shares Each Representing A 1/400th Ownership Interest In A Share Of 7.00% Fixed-rate Reset Non-cumulative Perpetual Pref (HTLFP) available here: HTLFP.

HTLFP Ratings for April 22:

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Weak | Neutral | Strong |

| P1 | 0 | 0 | 23.98 |

| P2 | 24.63 | 24.65 | 25.03 |

| P3 | 24.84 | 24.88 | 25.83 |

AI Generated Signals for HTLFP

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

- Factset: Request User/Pass

- Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Instructions:Click the Get Real Time Updates button below.

In the login prompt, select forgot username

Type the email you use for Factset

Use the user/pass you receive to login

You will have 24/7 access to real time updates.

Click the Get Real Time Updates button below.

In the login prompt, select forgot username

Type the email you use for Factset

Use the user/pass you receive to login

You will have 24/7 access to real time updates.

From then on you can just click to get the real time update whenever you want.

Our Market Crash Leading Indicator isEvitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change:Take a Trial

This is not EF Hutton, but it could be more #powerful. A picture speaks a thousand words, they say, and the #priceaction of Heartland Financial Usa Inc. Depositary Shares Each Representing A 1/400th Ownership Interest In A Share Of 7.00% Fixed-rate Reset Non-cumulative Perpetual Pref (NASDAQ: HTLFP) tells an important story. The movement tells us where investors perceive value, or the lack of it, and if we pay attention we can capture opportunity. The data below for HTLFP can be used as an example, and demonstrate how to do this for other stocks too. This data was current at the time of publication, but it is not updated in real time here. If you want real time updates, or data on a different stock, please get one here Unlimited Real Time Reports.